Today’s Rates

View More →- 5.25% APY* 12-mo Certificate

- 6.49% APR* 60-mo Auto Loan

- 4.25% APY* Money Market

Proudly Serving Members and Employees of The Church of Jesus Christ of Latter-day Saints

There are multiple ways to be eligible for an account, whether it is through your employer, a family member or being a church member. Find out if you are eligible for membership.

When you bank with us, you’re investing in YOU.

Everyone has a “why” in life, it may change from time to time. Your why is what drives you, the reason why you get up and do what you do. As a member of Deseret First we want to know your why in order for us to “show” you the best way financially to support it. That is why our tagline is “You Know Why, We Show How”.

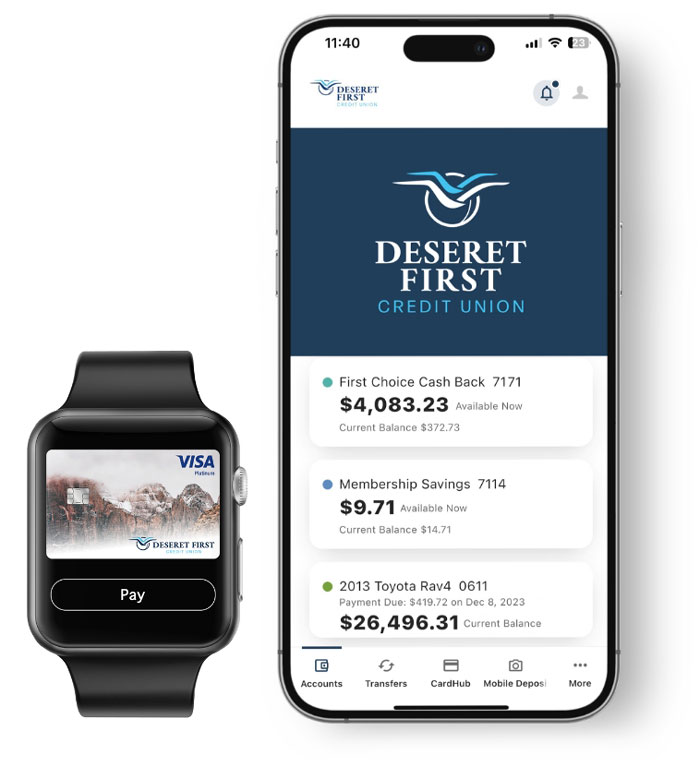

Learn MoreBank virtually anywhere with Deseret First.

-

All your finances in one place.

Link external accounts to your mobile app and have a snapshot of all your finances.

-

Deposit your checks.

No need to go into a branch, use your mobile app to instantly deposit your checks.

-

Pay your bills.

Never miss a bill again. Manually pay bills or set a schedule to pay recurring bills.

-

Total control over your cards

Manage your cards within the DFCU mobile app. Set spending limits, track activity, set alerts or freeze your card. Have complete security and control from your phone.

Discover More Services

Financial Education

Knowledge is power; arm yourself with our free financial education literacy. Learn from professionals in the financial world. Watch videos, take courses, use calculators, etc.

Start LearningFraud Prevention

Fraud is at an all time high! Protect yourself with best practices on how to spot fraud. Deseret First is committed to member security by intercepting fraud before it happens.

Prepare NowGiving Back

Community involvement and giving back is at the core of our values. Learn about the Deseret First Charitable Foundation and how we are supporting our membership.

Help Today